GAAS(Growth-as-a-Service)

We provide financing option for executives in traditional conglomarites, such as R&D carve-out, secondary M&A, distressed M&A. Besides building buy-side VC/PE platform, we are investing in high margin, high growth business that will be migrated into high EBITDA stream after decades.

HITSERIES®CAPITAL is providing Growth-as-a-Service™︎(GaaS) to our portfolio. Based in our criteria, current geographic focus is APAC, industry focus is AI/ML, vertical SaaS applications, connected IoT, healthcare, mobility, fintech, marketplace.

PE/VC hybrid strategy

Most seed and series-A investors(angels, VCs) have less than 1% of probability to generate unicorn. But we know there is some GPs group who have over 10% of success ratio bringing up unicorns several times. For funds with vintage-size around $300 million, its relatively easy to hit 30% to even over 60% IRR in 5 years(This explains the rapid growth of firms like Sequoia and Kleiner Perkins in 1980s). But if fund vintage size is more than $1billion, venture capital industry is less likely to generate stable performance over IRR benchmark of 12%(VTI,SPY), so R&D carve-out strategy like Vista Equity Partners or Francisco Partners performing better than VCs in 2020s.(they are PE rather than VC) This is what we learned from PE/VC history. HITSERIES CAPITAL is taking hybrid mezzanine strategy between VC and PE.

OPEX of VC dramatically decreased

Thanks to recent innovation of toolkits of fundraise, manage PE/VC, the power of law in VC also changing. There is solo VCs(Elad Gil and others), GP-led secondaries, GPU economy focused 3-year(+2) duration VCs.

Growth-as-a-Service™

HITSERIES CAPITAL is leveraging our Growth-as-a-Service™ offerings.

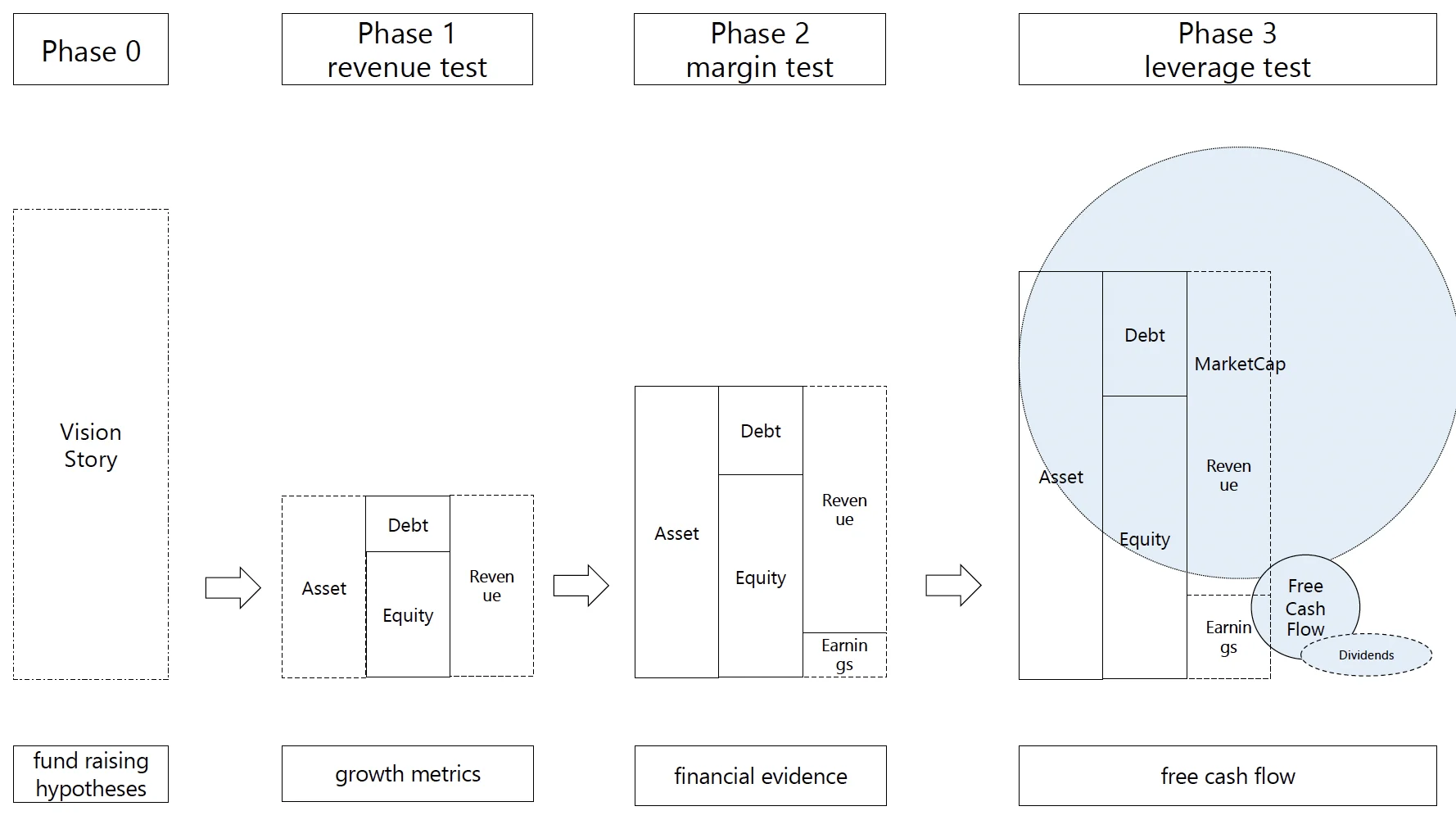

How to migrate your story into market cap.

0. hypotheses

fund raising with clear hypothesis and plan

1. Revenue test

build growth metrics that convert innitial capital into asset and revenue

2.Margin test

after confirming growth metrics, prove earnings and operating cash flow margin

3. Leverage test

leverage business while keeping and improving profit margin and FCF margin

After COVID-19 pandemic and rise in federal interest rate, there is no LP investors that invest in GPs (or startups) without accountability in clear path to free cash flow. Solid financial evidence can explain the probability of successful exits. TANAAKK provides Growth-as-a-Service™ to measure and control “hyper growth” which mean new revenue stream and incremental free cash flow for organizations. TANAAKK enhance entrepreneurs potential to coordinate sustainable financial return. Growth-as-a-Service™ is comprised of several HITSERIES®︎ products which have clear vision/story and measurable path to cash stream: logical financial strength. TANAAKK continuously invest into “how to migrate R&D into new recurring and incremental revenue stream, that eventually resulting in to competitive free cash flow.

Case Study

To enhance a company’s profitability and competitiveness through AI/ML, a data collection model and infrastructure are indispensable prerequisites. Additionally, it requires an high margin organization that can utilize its profitability to continue investing and its capital raising capabilities by leveraging future revenue and cashflow.