What we will invest

We invest in organizations that embody timelessness and modernity. You should perceive both celestial long gravitational waves and high frequency quantum wave like multi-messenger astronomy -Shoichiro Tanaka, founder of HITSERIES CAPITAL

What HITSERIES CAPITAL seeks are innovative companies with strong fundamentals. We don’t limit ourselves by industry or geography. What matters most to us is whether a company has identified a genuine truth and can convincingly demonstrate its validity. This kind of approach often leads to sustainable free cash flow growth.

HITSERIES CAPITALは地域、産業区分、ビジネスモデルを問わず、Truth theoremを発見し、実証することでコンペティティブなフリーキャッシュフローを産むことができる事業に投資しています。

売上総利益率75%以上、売上総利益額の成長が30%以上、EBITDA Marginが50%以上のビジネスへの投資を基本としており、厳格な財務計画に従ったベンチャー経営を実施することで、2021年のGrowth-as-a-Serviceリリースから2023年までの3年間でポートフォリオの売上成長率は20倍を超えています。(CAGR年間売上成長率約2.75倍))

1.Gross profit growth >30%

Revenue grows by raising capital. Asset turnover is 100% in standard conglomerates. We are finding high capital efficiency company that can grow revenue by limited capital.

2.Gross Margin >75%

When startups grow, they are decreasing capital but if there is apprporeate gross margin, there is a chance to turnaround the company.

3.EBITDA Margin>50%

We are finding best companies, that can generate >50% EBITDA. the minimum accepted EBITDA plan is 30%.

Economies of scale

When and how we should invest is based on fundamental observation. There is historical wisdom in mass production.

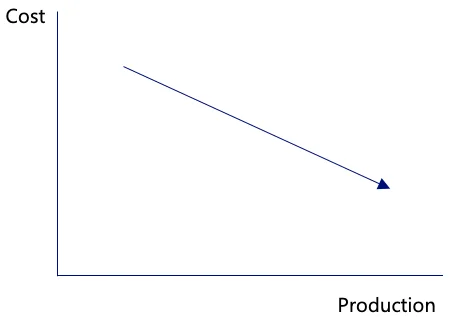

Wrights law

Theodore Wright in 1936, Wright’s Law states that for every cumulative doubling of units produced, costs will fall by a constant percentage. Learning curve.

Moore’s law

Moore’s law is the observation that the number of transistors in an integrated circuit (IC) doubles about every two years.

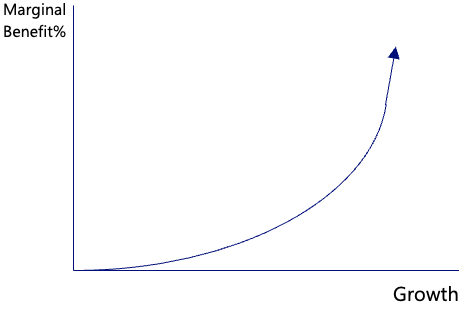

Marginalism law

Marginalist revolution started in 1870s. Marginalism is a fundamental concept in economics that focuses on the incremental or additional changes in costs and benefits associated with a decision.

How to design world’s future

There is apperent bottle neck for people who live on the earth. We have to tackle these challenge by technology innovation.

World wealth turnover

Aged countries require new level of wealth management. Developing countries have new HNWI and UHNW individuals. World wealth reach 510 trillion USD in 2023, 45% real estate, 25% bonds, 20% public equities, 5% Alternatives. US VC history tells alternatives will dominate 60% of public market after 30 years.

Computing power

Observation of molecular and universe is now zepto meter(10^-21) scale and printing technology by extreme ultraviolet lithography is now mass producting 3nm(in 2023). Photon size planck unit is predicted to be 10^-35. every year human beings can observe smaller and smaller size. Relativistic Heavy Ion Collider (RHIC) can generate 3.88trillion celcius that can break gold ion, same degree of bigbang

Clean energy

Energy consumption per head and GPU per capita is definetely correlated. The country’s strength is fully influenced by enegy capacity. But cities cannot widen capacity of traditional way(coal, LNG) low emmission altenative enegy generation and efficient grid management (demand supply forecasting) will be the next turnkey in global wealth.

What we will “not” invest

Startup is industrial game changer. If that game changer’s vision is too small, too narrow or too poor in margin generation, then investors cannot bet them. Here is some cases we will not invest in the startup.

HITSERIES CAPITALでは我々がCompetitive valueを提供することのできるSynergy investmentを基本としています。一般的なベンチャーキャピタルが実施するPure investmentには従事していません。HITSERIES CAPITALでは資本政策、レベニューモデル、経営データインフラ、サプライチェーンリストラクチャリングを含む総合的なエグジットまでのサービスを提供しています。Pure InvestmentのみでVTIやSPYなどのトータルインデックス(IRR12%)を超えるようなキャッシュリターンを生み出すことはとても困難ということがデータにより明らかになっているからです。

The goal is too small, less than $1billion

If a startup’s mid term exit goal is less than $1billion market cap, we will not invest in that startup. We are primary investor in risky startups but we have to invite other investors in secondary market. If startup’s mid term goal is too small, less than $1 billion, early investors or secondary investors cannot exit.

HITSERIES CAPITALでは売上がゼロのPre -revenue productに投資することはありません。

Pre-revenue company without truth theorem

We will not invest pre-revenue company. If the starup have clear theorem that is apparently true, the truth can easily earn revenue.

HITSERIES CAPITALでは売上がゼロのPre -revenue productに投資することはありません。

Lower margin business than benchmark

If the startup’s revenue is growing, we will not invest if the startup have less margin as compared to industry giants or benchmarking peer group. We will only invest in potential industrial category leaders.

売上が成長しているとしても、売上総利益率が同業最大手よりも低い企業や、EBITDA MARGINが低い企業には投資をしません。

3y-CAGR is less than 10%

Startup is the organization that can beat market index, SPY or VTI. If annual growth rate is less than 10%, there is no possibility for startups to ask investors take away SPY and invest the less performing private company(lack of marketability). Startup should have risk premium to invest in.

数字は想像以上に企業の性格や実力を語ります。HITSERIES CAPITALでは前年度比で減収している企業や、前年度比で売上総利益率やEBITDA marginが1%でも減っている事業については、抜本的な経営改善が必要だと考えています。

Lack of clear path to profitability(EBITDA)

ユーザー増やMRR、ARR増が強調されるスタートアップ業界ですが、HITSERIES CAPITALは新しく生み出される「市場」はないと考えています、常に「市場」は先行事業者から奪うものであり、市場占有率を急速にたかめるために必要なのは、資本であり、同業最大手よりも優位な資本効率を持っている企業のみが、伝統的大企業を駆逐することができるということは歴史が証明しています。つまり、同業最大手よりも、EBITDA MarginやFree cash flow Marginが高い企業しか、イノベーションを起こすことはできません。

Too modern without timelessness

The rule of startup is at first starting from small audience, and in the last, take away existing traditional players market. So it should be modern but it should also be accepted by traditional players in the last. Timelessness and modernity is both required in hypergrowing organizations. As if you have both long gravity waves and high frequency quantum wave.

HITSRIES CAPITALでは最先端のテクノロジーを用いていつつ、伝統的な産業にも影響力を与えうる企業にのみ投資をしています。ただ単に最先端だけではコンペティティブなキャッシュフローを生み出すことが難しいからです。

Lack of open market principles

HITSERIES CAPITAL believes there is universally acceptable open market priciples in global economy. The power of common wealth is stronger than government intervention or sole country consumption power that history proved. Adam Smith, Milton Friedman, Friedrich Hayek

HITSERIES CAPITALではOpen Market, Free market プリンシプルを前提とした市場経済に最終的に終着するという歴史的知見を元に投資先を評価しており、ドメスティックなUSD経済以外の国における単一国でのプレイヤーには投資をしていません。

The rule of open market

Historically the relationship between open market power and government intervention is analysed. How we can predict the future of industry, we can utilize free-market capitalizm theories.

Adam smith

1723-1790

Adam Smith is Scottish economist and philosopher. who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as “The Father of Economics” or “The Father of Capitalism”, he wrote two classic works, The Theory of Moral Sentiments (1759) and An Inquiry into the Nature and Causes of the Wealth of Nations (1776).

Friedrich Hayek

1899-1902

Friedrich August von Hayek was an Austrian-British academic, who contributed to economics, political philosophy, psychology, and intellectual history.Hayek shared the 1974 Nobel Memorial Prize in Economic Sciences with Gunnar Myrdal for work on money and economic fluctuations, and the interdependence of economic, social and institutional phenomena.

Milton Friedman

1912-2006

Milton Friedmanwas an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy.

Free-market capitalism

Free-market capitalism, also referred to as laissez-faire capitalism, is an economic system built on a few core principles. Real-world free markets are not completely free. Most countries have some government regulations to protect consumers, workers, and the environment. Understanding its core principles is a good starting point. State capitalism or Oligopoly are both utilizing basics of free-market capitalism

Individual Liberty

People are free to pursue their economic self-interest. This means freedom to choose what businesses to run, what jobs to take, and what goods and services to buy and sell.

Private Property Rights

Individuals and businesses own and control the factors of production, like land, factories, and machinery. They can use these resources as they see fit.

Perfect Competition

Businesses compete with each other for customers. This competition drives innovation, efficiency, and keeps prices in check.

Price is determined by supply and demand

The price of goods and services is determined by the interaction of supply (how much is available) and demand (how much people want to buy). Prices rise when demand is high and fall when there’s a surplus.

Strategic Government Intervention

The government plays a minimal role in the economy. It doesn’t set prices or production levels, but instead focuses on enforcing contracts, protecting property rights, and providing essential public services.

The results of free market

-Businesses, motivated by profit, will look to produce what consumers want at the most efficient cost.

-Competition ensures that businesses constantly strive to improve their products and services.

-Consumers, with their buying power, determine which businesses succeed.

Potential challenge of free market

Income Inequality: Free markets can lead to a concentration of wealth at the top.

Market Failures: In some cases, markets may not allocate resources efficiently, leading to issues like pollution or lack of investment in public goods.

Limited Social Safety Net: With minimal government intervention, there may be less support for the poor, unemployed, or sick.

Turn around/Secondaries capability

上記HITSERIES CAPITALの投資方針を満たす企業は世界16万社のうち、330社しか存在しません。HITSERIES CAPITALでは投資とともに、財務体質の改善とエグジットまでのエクイティストーリーをセッティングすることにより、99.99%での投資成功を実現しています。

Investment forcus

R&D Carve-out

Entity restructuring

Revenue model pivot

Distressed turn around

Growth-as-a-Service network

Law firm(PE/VC, Startup law)

Wealth advisors(Tax, Accounting, Private banking)

Institutional investors(Bank/Hedge fund/PE/VC)

US SEC/FINRA registered bloker/dealers

Cap table management

Revenue Operation/ ERP

CICD/SRE/TLPT/SoC

Turn around capability of HITSERIES CAPITAL

HITSERIES CAPITALでは3つのコスト削減によりCompetitiveなベンチャー経営を実現するTurn aroundサポートをしています。

1

Capital cost

資本コストはFederal interest、Prime loan rate, US treasury yieldなどのマクロ指標によりベンチマークが定義され、SPY、VTIが最も再現性の高いIRRとして設定されています。

2

Product&service cost

資本回転率は100%というのがコングロマリットの平均であり、資本回転率100%超えるような売上の創出、Gross Margin 75%, EBITDA 50% の指標を実現するための販管費リストラクチャリングをサポートします。

3

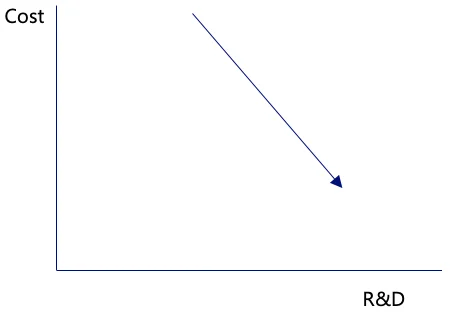

R&D cost

R&Dの目的は、以下の2つしか存在しておらず、 R&Dの明確な経営改善効果を説明できるようサポートします。

1.既存事業のOPEX削減及び利益率の向上

2.成長の減退した既存事業の内部留保を活用して既存事業の経営効率及び全世界のベンチマークを超えるROEを生み出す事業への投資

Free-market capitalizm in software industry

The basics of capitalizm can be applied in hardware and software industry.

Computational complexity

Physics deals with fundamental elements and their interactions, which are relatively unchanging. Software, on the other hand, is a constantly evolving field with a vast array of technologies, tools, and languages. Standardizing everything would stifle innovation.

Modularization

Software can be broken down into smaller, reusable components (modules) that can be combined in various ways, similar to how elements can combine to form molecules. Microservice architecture is easy disposable modularization.

Standardization

Industry groups and organizations set standards to ensure compatibility and interoperability between different software products. These standards can be categorized into different areas like networking protocols (TCP/IP), programming languages (Java, Python), or data formats (PDF, JPEG).

Open-source, Proprietary combination

software can be open-source (freely available and modifiable) or proprietary (owned by a specific company). This distinction creates a range of options and approaches, dominant software always have proprietary version control and open-source bug hunting open to anyone.

Compatibility

compatibility refers to the ability of different programs or systems to work together seamlessly. This means they can exchange data, run on the same platform, or function together without issues.

Interconvertibility, interoperability

modern software industry standardize infrastructure and code procedure, align skillset and career opportunity. Realizing easily convertible experience in industry( smoothly change job), similarly not only software engineer, but also intellectual assets and company entity level, it will be bette to have interconvertibility, easy to operate in other countries, currencies, work well in different cultures.

autonomous, independent

How software startup can be autonomous and independent, that require contenuous innovation, contenuous customer acquisition and creating sustainable investors return. What makes startup independent is the financial soundness and self-reproduction capability. Reproducibility

Oligopolies and state capitalisms

An oligopoly is a market structure where a small number of large companies dominate a particular industry. These companies have significant control over prices and production within that industry. They are interdependent, meaning the actions of one company can significantly impact the others.

Oligopolies can invest heavily in research and development, leading to stable innovation cycle and advancements in software technology. Large companies can leverage their size to achieve economies of scale, potentially leading to lower prices for some products.

State capitalism is often seen high performing states or countries like Singapore or Hongkong, Shenzhen. This refers to an economic system where the government plays a significant role in owning or heavily regulating businesses. The government may own key industries, partner with private companies, or influence markets through regulations and subsidies. State capitalism controll financial infrastructures, utilities(power supply, water, waste management), transportation, roads, bridges whereas usually bases on free-market capitalism about industry, inviting foreign direct investment and top talents. State capitalism usually see high performing real estate, efficient use of land, improvement in population and GDP per capita.

Operating Systems

A prime example is the market for operating systems for personal computers. Companies like Microsoft (Windows), Apple (macOS), and (to a lesser extent) Google (ChromeOS) control a vast majority of the market share.

Productivity Suites

Similar dominance exists in productivity suites like Microsoft Office and Google Workspace (formerly G Suite). These software packages offer a range of tools for word processing, spreadsheets, presentations, etc., making them near-ubiquitous in office settings.

Cloud Computing

The cloud computing space is another example, with companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) being the major players. They offer businesses a range of on-demand computing resources like storage, databases, and servers.

Whats the next

The hint to be next oligopoly is to utilize current infrastructure better than any other. Riding on the shoulders of giants will be the best strategy for new players.